Another reason for a high ratio is the effectiveness of the collection method the company employs.Ī fair screening process that helps the business identify customers whit potential delays in payment also benefits the company as it helps us minimize the doubtful and bad debt. This, in turn, helps the business to pay its payroll and debts to suppliers quickly. It can mean that clients settle their dues timely, which increases the company’s positive cash flow. Higher RatioĪ higher ratio indicates we are turning over trade receivables faster, and customers settle debts more quickly. The metric shows the effectiveness with which the business manages credit and debt collection. The better collection generally equals a higher rate.

Thus, the ratio has a direct link to collection from clients. Credit sales exclude cash sales, as they do not generate receivables.

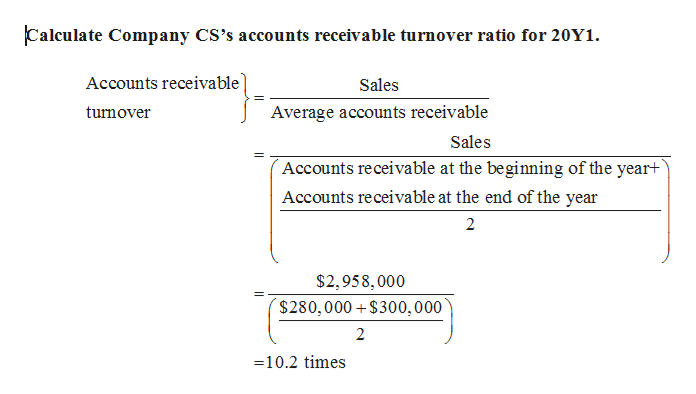

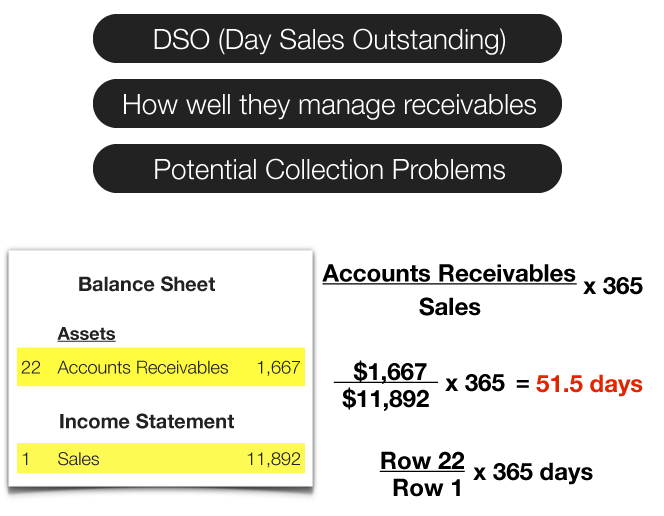

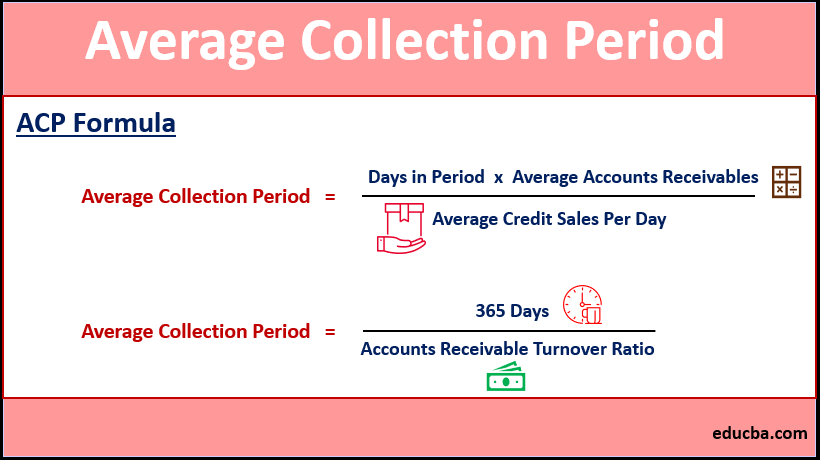

The Accounts Receivable Turnover Ratio helps us evaluate the company’s credit policies. When calculating the Accounts Receivable Turnover in Days, we need to align the Days in period with our AR T/O calculation period. This metric shows the average number of days it takes customers to pay their debts. Accounts Receivable Turnover in DaysĪnother metric we can look at is the representation of the ratio in days. Now that we have the Net Sales and the Average Accounts Receivable, we divide them and arrive at the Accounts Receivable Turnover Ratio. In specific circumstances where there are significant fluctuations near the beginning or end of the period, we might do a weighted average calculation. We calculate it as the average amount between the opening and closing balances for a period corresponding to net sales. These include the average amount that customers owe to the company. Next, we deduct any returns or doubtful debt allowances. These exclude cash sales and other sales where the company did not extend credit to its customers. We start with credit sales for the period. We calculate the metric via the following formula: We track the ratio over time to analyze its development and spot patterns. We can calculate the measure on an annual, quarterly, or monthly basis, depending on the business and our needs.

The ratio helps us analyze how well we manage the following debt collection. The Accounts Receivable Turnover ratio is a measure in accounting that enables the business to quantify its ability to manage credit collection effectively.īy holding trade receivables, we are extending interest-free loans to our customers. What is the Accounts Receivable Turnover Ratio Generally, we prefer a higher ratio, which means the business is more efficient at collecting due amounts from its clients. We can’t run a company on low cash flow, so it’s vital to have efficient debt management. Managers often pay more attention to sales and margins and not enough attention to their accounts receivable and collection. We calculate the ratio by dividing net sales over the average accounts receivable for the period. It is also known as the Debtor’s Turnover ratio, and we use it to gauge how effectively the company manages credits they extend to customers and collection. The Accounts Receivable Turnover ratio (AR T/O ratio) is an accounting measure of effectiveness.

0 kommentar(er)

0 kommentar(er)